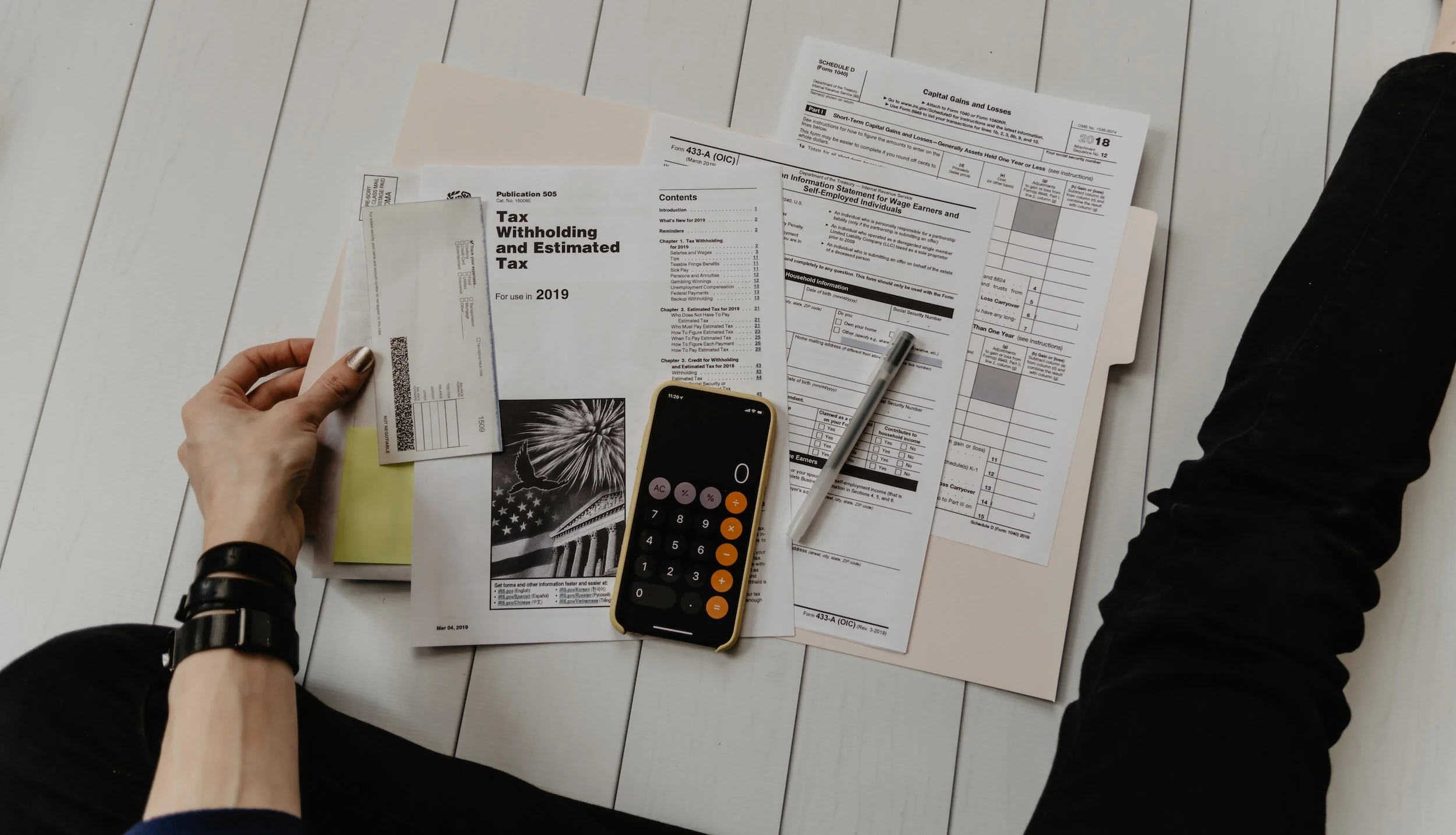

Navigating the complexities of the Affordable Care Act (ACA) can be overwhelming for employers of all sizes. Our brokerage is here to provide you with the expert guidance and support you need to stay compliant and focused on your business goals.

Read MoreThe Affordable Care Act (ACA) was designed to ensure that employees were offered timely and affordable healthcare by their employers. Read the article to find out reporting deadlines, common mistakes to avoid, and more.

Read MoreThe Internal Revenue Service announced an increase in the 401k and IRA contribution limits for 2024. Now you can save even more for your retirement and secure a brighter tomorrow.

Read MoreUnder this new proposal, any non-exempt employee who is on a salary and does not have supervisory responsibilities can earn up to $55,000 per year. If their salary falls below this threshold and they work more than 40 hours in a week, you would be obligated to pay them overtime, which is calculated at 1.5x their hourly rate.

Read MoreThe IRS recently stopped processing Employee Retention Tax Credit (ERTC) claims. The ERTC was introduced during COVID as a pandemic-related tax credit that offered money to help employers that retained their employees during the pandemic.

Read MoreThe SECURE Act, which was enacted in 2019, introduced a wide range of comprehensive enhancements to retirement savings plans, resulting in significant improvements for individuals preparing for their future financial security and stability.

Read MoreA new Form I-9 (Rev. 08/01/23) will be available for employers to use on or after August 1, 2023, and once released can be found on the USCIS website.

Read MoreFederal employment law is about to give birth to some long-overdue requirements. As of June 27, 2023, employers with 15 or more employees must provide pregnancy-related accommodations to employees and applicants under the federal Pregnant Workers Fairness Act (PWFA).

Read More